Asset Turnover Ratio Standard

This is an efficiency ratio and therefore it focuses on how. 500000 2000000 025 x 100 25.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

The asset turnover ratio is an efficiency ratio that measures a companys ability to generate sales from its assets by comparing net sales with average total assets.

. Investors use the asset turnover ratio as one of the indicators of business efficiency. Asset turnover is the ratio of total sales or revenue to average assets. The asset turnover ratio is an efficiency ratio that compares the companys sales to its asset base.

Asset turnover ratio measures the value of a companys sales or revenues generated relative to the value of its assets. Fixed Asset Turnover FAT is an efficiency ratio that indicates how well or efficiently a business uses fixed assets to generate sales. You can use the asset turnover rate formula to find out how efficiently theyre able to generate revenue from assets.

74 rows Asset turnover is a measure of how efficiently management is using the assets at its disposal to promote sales. Total Asset Turnover SalesTotal Assets where Sales come from the. The Asset Turnover Ratio is an asset management ratio.

Broadly most analysts consider a ratio of above 10 to be good. Asset turnover ratio Net sales Average asset value. The asset turnover ratio is a financial ratio that measures how much sales a company generates from its assets.

To calculate the ratio in Year 1 well divide Year 1 sales 300m by the average between the Year 0 and Year 1 total asset balances 145m and 156m. They can look at the efficient increment or decrement of the total assets. The asset turnover ratio measures the efficiency with which a company uses its assets to generate sales by comparing the value of its sales revenue relative to the average.

Compare the result to the industry standards and competitors. This ratio divides net sales by net. To calculate your accounts receivable turnover ratio.

Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. More Capital Expenditure CapEx Definition. 122 rows Asset Turnover Ratio Ranking by Sector.

However for a company the value to aim for ranges between 025 and. Upon doing so we get 20x for the total. If a company has an asset.

It measures the companys ability to generate revenue from its assets. However as the Asset Turnover Ratio varies a lot between industries theres no universal value to strive towards. In the retail business when the value of the total asset turnover ratio exceeds 25 it is considered good.

A high asset turnover ratio indicates that a company. This metric helps investors understand how effectively companies are using their assets to generate sales. It measures the ability to produce sales from available assets of the company with the help of net sales and average total assets.

This means that Company As. This indicates that the company is able to generate revenue. Asset turnover ratio Net sales Average total assets.

Revenue Average total assets or in days 365. As evident Walmart asset turnover ratio is 25 times which is more than 1. This ratio determines if your company is generating enough business given its total asset investment.

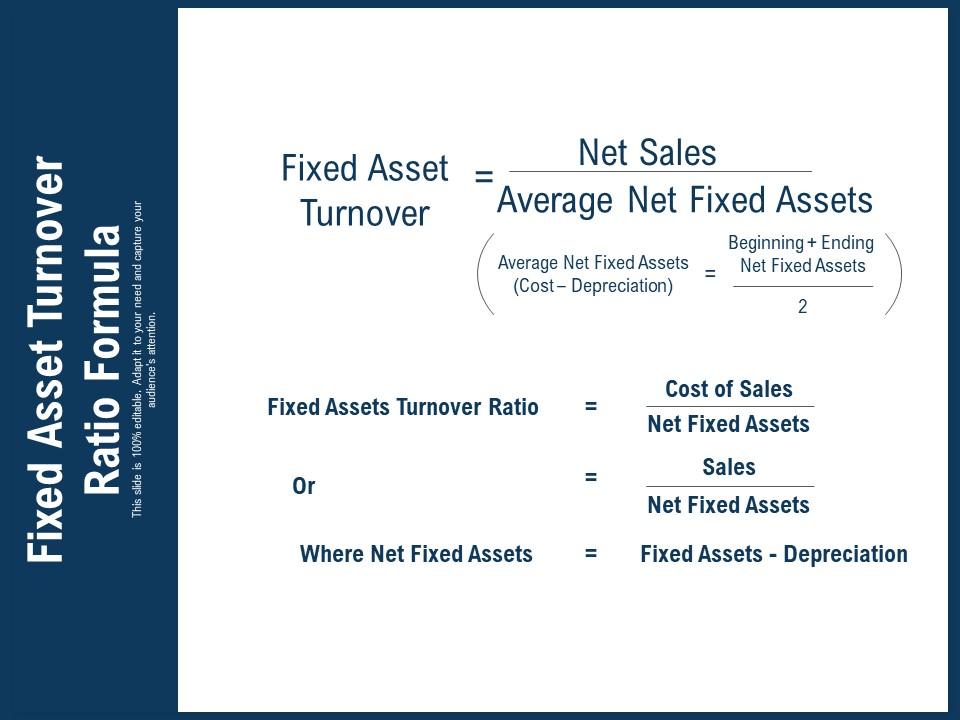

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

Asset Turnover Ratio Formula Calculator Excel Template

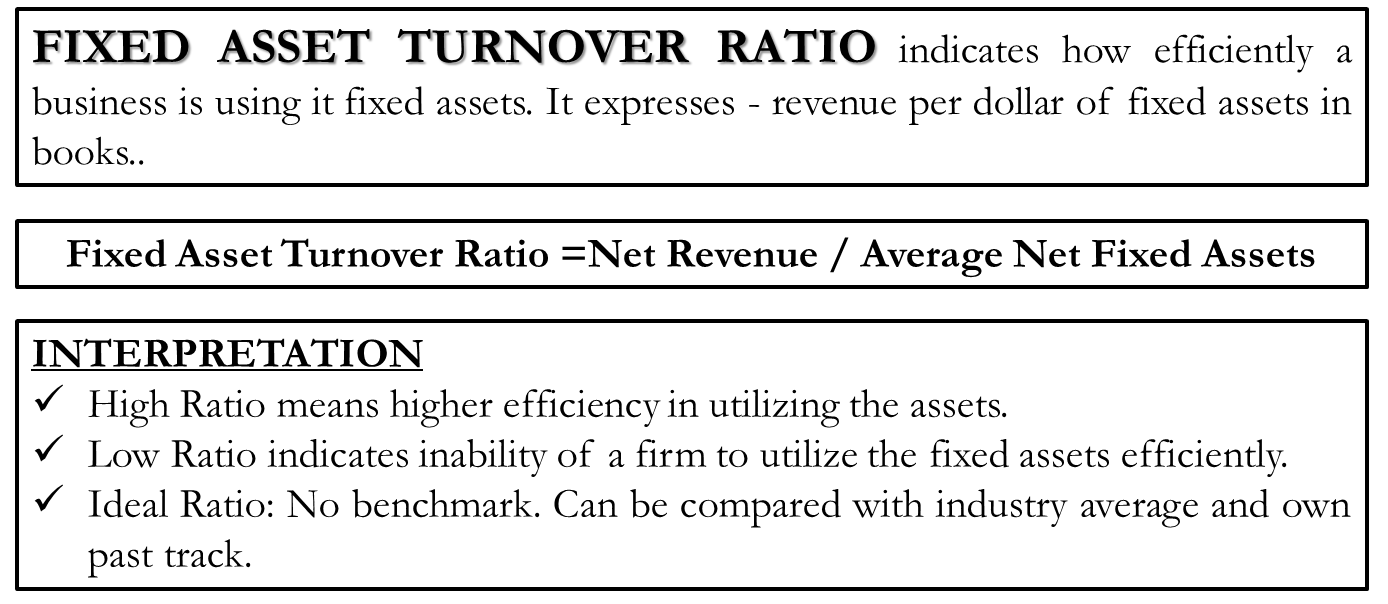

Fixed Asset Turnover Definition Formula Interpretation Analysis

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

0 Response to "Asset Turnover Ratio Standard"

Post a Comment